Freelancers have a unique lifestyle. Unlike traditional employees who receive a regular paycheck every two weeks, freelancers often face the challenge of unpredictable income streams. Some months bring in a flood of work and money, while others may be quieter. Without a structured income flow, it’s easy for freelancers to feel overwhelmed by financial uncertainty, which can quickly lead to stress.

This is where a paycheck generator becomes an invaluable tool for freelancers. In this blog post, we will dive deep into why every freelancer needs a paycheck generator for financial organization, and how this simple tool can streamline your finances, ensuring you’re always prepared for both the highs and lows of freelancing.

What Is a Paycheck Generator?

A paycheck generator is a digital tool designed to create pay stubs (or paychecks) for freelancers, self-employed workers, or anyone not on a fixed salary. While traditional employees receive paychecks from their employers with detailed breakdowns of their wages, taxes, and deductions, freelancers have to manage this on their own.

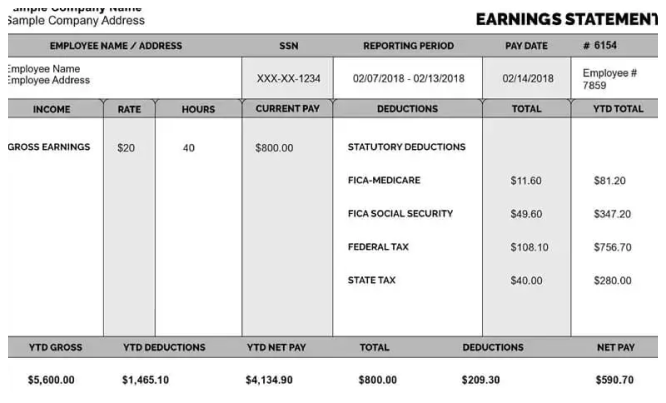

A paycheck generator helps freelancers create professional-looking pay stubs, even if their income isn’t the same from month to month. These pay stubs can include details like the gross amount earned, tax deductions, benefits, net income, and more. They can be used for various purposes, such as applying for loans, tax filing, or simply keeping track of earnings.

Now, let’s look at the reasons why this tool is essential for freelancers.

1. Organizes Income for Better Budgeting

One of the most significant challenges for freelancers is managing inconsistent income. You might earn well in some months and less in others, which can make budgeting difficult. Without a fixed paycheck, it’s easy to lose track of how much money you’ve made, which can lead to overspending or under-saving.

A paycheck generator allows freelancers to create detailed records of their income for each project or month. This provides a clear breakdown of what’s coming in and helps you track where your money is going. By generating regular pay stubs, you can estimate future income more accurately and plan your budget accordingly. Whether you’re saving for taxes, personal expenses, or business investments, having a pay stub can help you make smarter financial decisions.

2. Helps with Tax Preparation

Freelancers are responsible for managing their taxes. This can be a complicated process, especially when your income varies from month to month. As a freelancer, you may need to pay self-employment taxes, income taxes, and potentially other state or local taxes. You are also responsible for tracking your income and deductions throughout the year.

A paycheck generator simplifies this task by providing a clear breakdown of your earnings and deductions, which can be helpful during tax season. The generator can also help you calculate your net income after taxes, making it easier to set aside the appropriate amount for tax payments. By using a paycheck generator, you can ensure that you’re properly tracking your income and avoid surprises when tax time comes around.

3. Professionalism in Financial Reporting

As a freelancer, maintaining a professional image is essential—especially when you are working with clients or seeking business opportunities. Clients may request pay stubs, invoices, or financial reports to verify their earnings or assess your financial stability. A paycheck generator helps you create clear, professional pay stubs that can be shared with clients, banks, or potential lenders.

If you’re applying for a loan or a credit card, for example, having a formal pay stub from a paycheck generator can prove your income, showing banks or other institutions that you are financially reliable. It adds a level of professionalism to your financial records and ensures you’re taken seriously in business matters.

4. Keep track of Your Earnings and Expenses

Another key benefit of a paycheck generator is that it keeps track of your earnings, taxes, and any expenses you’ve incurred. Freelancers often have multiple clients, projects, or sources of income. Managing all of these streams can be difficult, especially if you don’t have a central system for recording your earnings.

Paycheck generators can provide a detailed breakdown of each payment, including the rate, hours worked, and taxes withheld. Some advanced generators even allow you to track business-related expenses, which can be deducted from your taxable income. This information is incredibly helpful when filing taxes, as it ensures you don’t miss out on potential deductions. You’ll also have a clear picture of your financial situation, which is essential for making informed business decisions.

5. Helps You Set Aside Money for Taxes

As a freelancer, it’s crucial to set aside money for taxes, especially since you don’t have an employer withholding them for you. If you’re not careful, it’s easy to forget about taxes or underestimate how much you need to save. This could lead to a tax bill you’re not prepared for when it’s time to file.

A paycheck generator helps you plan by showing you how much you should be saving for taxes with each payment you receive. For example, if you generate a pay stub and see that your income is $5,000 for a project, the paycheck generator can break down the potential tax deductions based on your estimated tax rate. It can help you allocate a portion of your income toward tax savings, ensuring you’re not caught off guard when tax season arrives.

6. Simplifies Applying for Loans or Mortgages

When you need to apply for a loan or a mortgage, one of the key documents financial institutions look at is proof of income. Since freelancers don’t have the same kind of steady paycheck as salaried employees, providing evidence of your income can be tricky.

With a paycheck generator, you can create pay stubs that provide a clear record of your earnings. This documentation can serve as proof of your financial stability when applying for loans, credit cards, or mortgages. Many lenders accept pay stubs from freelancers who use paycheck generators because they show a consistent, reliable income stream, even if it’s not always predictable.

7. Ensures Legal Compliance

Freelancers must also remain compliant with local, state, and federal tax laws. This means keeping accurate records of your income and ensuring that you’re paying the appropriate amount of taxes. While a paycheck generator doesn’t handle all of the details for you, it does help you maintain organized financial records that align with legal requirements.

If you’re audited, having a clean record of your earnings and taxes paid can make the process much smoother. A paycheck generator can provide the necessary paperwork that proves you’re following the rules and paying your fair share of taxes. This can give you peace of mind knowing that your finances are in order and that you’re in compliance with tax laws.

8. Helps Manage Multiple Clients

Freelancers often juggle multiple clients at once, making it harder to track payments for each one. Some clients may pay on time, while others might be late, and some may even withhold payments for specific reasons. A paycheck generator allows you to generate pay stubs for each client, helping you keep track of what you’ve earned and when you should expect payment.

With a clear record of each project or client, you can more easily follow up with clients who haven’t paid yet. You can also use your pay stubs to track which clients have paid and which ones are still outstanding. This helps you stay on top of your cash flow and ensures that you’re always paid on time.

9. Reduces Financial Stress

Ultimately, one of the best reasons to use a paycheck generator is that it reduces the stress of managing finances as a freelancer. Financial disorganization can be overwhelming, especially when you have multiple clients, fluctuating income, and taxes to consider. By using a paycheck generator, you can streamline your financial process and take control of your earnings, expenses, and tax planning.

Having a system that keeps everything organized can give you peace of mind, allowing you to focus on the work that truly matters—your projects. No more scrambling at the last minute to prepare your financial records or worrying about whether you’ve saved enough for taxes. With a paycheck generator, everything is laid out clearly, which helps alleviate much of the anxiety that comes with freelance work.

Conclusion

Freelancing offers great freedom and flexibility, but it also comes with significant financial responsibility. A free paycheck generator is an essential tool that can help you stay organized, professional, and prepared for tax season. Whether you’re managing income from multiple clients, saving for taxes, or applying for a loan, a paycheck generator helps streamline your financial process, ensuring that your finances are in order.

If you’re a freelancer looking for a way to simplify your financial organization, consider using a paycheck generator. It’s a simple, efficient tool that can help you stay on top of your income, expenses, and taxes while reducing the stress that comes with managing freelance finances.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season