Private loans have changed the way people borrow money today. You won’t need to wait in long bank lines or deal with strict rules anymore. Private lenders move faster and work around your needs, not the other way around.

HugeLoanLender stands out as a top choice in the private loan world. Their quick online system gets money to people in just 24 hours. With rates starting at just 5.99%, they’ve helped many borrowers reach their goals. They keep things simple, clear, and fast – just what you need when looking for money help.

Getting a loan should feel good, not scary. That’s why picking the right lender matters so much. You want someone who speaks clearly about costs and treats you like a real person. The best lenders make sure you understand every part of your loan before you sign.

Loan Terms and Repayment Flexibility

When you start looking at private loans, the first thing you’ll want to check is how the payments work. Your life can change a lot over time, so you need a loan that fits your money plans. A private loan lender in the UK will give you clear details about paying back your loan without any sneaky fees.

Most good lenders let you pick between shorter and longer payment plans to match your budget. You might want to pay off your loan faster with higher monthly amounts or spread it out over time with lower payments. The choice should always be yours to make based on what works for you.

- Pay back your loan early without extra fees – £500 saved on a £10,000 loan

- Choose 2-5-year terms for smaller monthly costs

- Switch payment dates when needed to match your pay schedule

You should be able to pick the amount, time frame, and payment style that feels right. This freedom helps you stay on track with payments while keeping stress levels low.

Interest Rates and Fees

Good lenders share their rates up front, making it easy to see what you’ll pay each month. When rates stay low, your bank account stays happy.

Most top lenders today keep their fees simple and clear. You won’t find any surprise costs hiding in the small print of your loan papers. Finding a lender who puts all costs on the table helps you plan better for your future spending.

- Fixed rates start at £495 per £10,000 borrowed yearly

- Zero hidden fees policy saves you £200-£300 in extra charges

- Clear monthly cost breakdowns show exactly what you’ll pay

Some loans come with fixed rates that stay the same, while others might change over time. A good lender will explain both types before you pick one. Fixed rates help you know exactly what to pay each month, while changing rates might save you money if market rates drop.

Top lenders will help you understand if your rate could change and by how much. This helps you pick the best choice for your money plans and future payments.

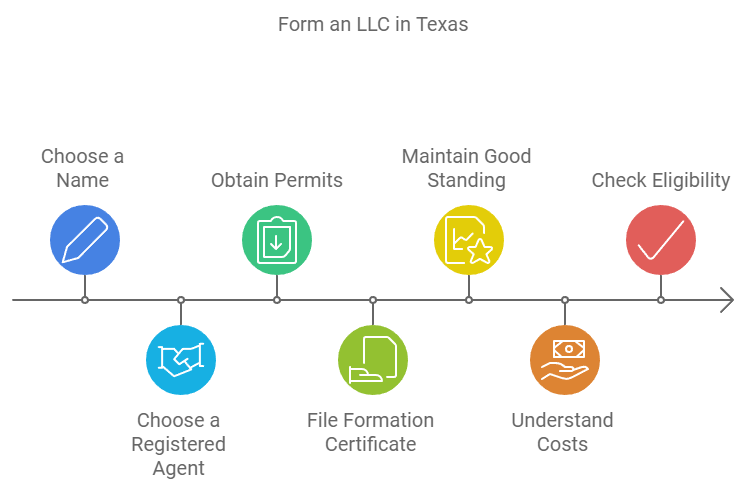

Eligibility Requirements

Many top lenders now look at more than just your credit score when you ask for money. You might think your job or money situation won’t work, but new rules make loans more open to many people. Good lenders check your whole money picture, not just one part.

The world of loans has changed a lot, and many lenders now welcome people with different kinds of jobs. You might work for yourself, have a side job, or earn money in new ways.

- Most lenders accept a £1,500 monthly income from any source

- Credit scores as low as 600 might work for your loan

- Papers ready? You could get your answer in 24 hours

You won’t need to send stacks of papers anymore. Most top lenders keep things quick and simple. They’ll ask for basic items like payslips and bank details. This means less time waiting and more time using your loan for what you need.

Moving fast matters when you need money, and good lenders know this. They’ve made their systems smooth so you can get answers quickly.

Speed of Loan Approval

Top lenders know you need money fast, so they’ve made things quick. Your time matters, and the best lenders respect that by moving at top speed with your loan request.

Now you can apply from your home and get answers fast. Most good lenders now use tech to check your details right away. This means less time waiting and more time planning what to do with your loan money.

- Fill forms in 10 minutes, get answers in 4 hours

- Money hits your bank as fast as the next morning

- Track your loan status live on your phone

The best lenders make sure you don’t waste time with old paper forms. You can snap photos of your pay slips, click a few buttons, and send everything they need. This quick process helps you get your money when you need it most.

Fast doesn’t mean careless, though. Good lenders still check everything properly. They just do it faster with better tech. This means you get your cash quickly while still having a safe, solid loan that works for your needs.

Loan Amount and Limits

You might need a small boost or a big chunk of cash. Most good loan companies start their loans at £1,000 and can go up to £50,000. This clear info helps you pick the right lender for your needs.

- Borrow from £1,000 up to £50,000 based on your needs

- Pick exact amounts like £3,750 rather than round numbers

- Business loans go higher, often up to £100,000

You can pick the exact amount you need. You won’t have to take more than you want or settle for less than you need. This means your monthly payments stay just right for your budget.

Lenders help make sure your loan fits your pocket without stretching you too thin. This keeps your payments comfy while helping you reach your goals.

Conclusion

After looking at all these points, you’ll want to pick a lender who feels right for your needs. This helps you feel sure about your choice. They make borrowing feel easy and keep stress away. When you find a lender who ticks all these boxes, you’ll know you’ve found the right fit for your money needs.

Take time to check each lender against these points. This helps you dodge problems and find a loan that works just right for you.

2 Comments

[…] not initially realize that they qualify for an MCA or may have specific reasons for preferring a business loan instead. By offering both options, you allow them to choose the best fit for their needs, while […]

[…] £1,000 in that case. These loans, in addition to unforeseen expenses, are aimed at meeting planned major expenses such as weddings and home refurbishments, to name a few. Compared to weekly instalment plans, […]

Comments are closed.