With the rise in life-threatening health conditions, selecting the right insurance policy has never been more crucial. Coverage for critical illnesses, designed to address major health issues like cancer, heart attacks, and strokes, provides financial protection to policyholders during challenging times. For families seeking the best coverage, understanding the differences between critical illness policies and regular health insurance for parents can significantly influence their decision-making.

This article talks about critical illness policies, highlighting their features, benefits, and how they compare with health insurance for parents. By making informed choices, families can ensure they are well-prepared to handle unforeseen medical expenses.

The importance of coverage for critical illnesses

Insurance for critical conditions provides coverage specifically for severe health issues that require extensive treatment. Unlike standard insurance, which primarily covers hospitalisation and routine healthcare costs, these policies offer a lump sum payout upon the diagnosis of a covered illness. This payout can be used to cover a range of expenses, from medical treatments and hospital bills to lifestyle adjustments and loss of income.

For parents and senior family members who may be at a higher risk of serious health issues, this form of insurance is an invaluable asset. It provides financial relief, enabling families to access high-quality treatment without the stress of immediate financial burdens. Pairing critical illness coverage with health insurance for parents creates a comprehensive safety net, covering both routine medical needs and more serious conditions.

Key benefits of critical illness policies

- Lump sum payout: A primary advantage of these policies is the lump sum payout upon diagnosis, which allows policyholders to use the funds for any necessary expenses, including medical treatments, alternative therapies, or even household bills if income is impacted.

- Coverage for a wide range of illnesses: Critical illness insurance typically covers various life-threatening conditions, such as cancer, kidney failure, and heart disease. Some policies also include rare but severe conditions, ensuring comprehensive protection for policyholders.

- Financial stability: Severe health conditions that require long-term treatment can lead to loss of income, especially for those needing extended leave from work. This insurance offers financial stability by covering both medical and personal expenses, allowing individuals to focus on recovery.

- Flexibility in fund usage: The payout from a critical illness policy is not limited to medical expenses. Policyholders can use the funds for lifestyle changes, home modifications, or even travel costs if treatment is required at distant locations.

- Peace of mind: Having coverage for critical conditions provides families with peace of mind, knowing they are financially prepared for unexpected health challenges. This assurance is especially important for ageing parents who may need additional support and specialised care.

Comparing critical illness coverage with health insurance for parents

While both critical illness coverage and health insurance for parents provide financial security, they serve different purposes. Understanding these differences can help families make well-rounded decisions about their insurance needs.

- Scope of coverage: Health insurance for parents generally covers hospitalisation, doctor consultations, and routine medical expenses. Critical illness policies are designed specifically for severe health conditions, providing a lump sum benefit upon diagnosis rather than covering ongoing healthcare costs.

- Usage of funds: With health insurance, funds are typically used directly for medical bills and hospitalisation costs. Critical illness coverage offers more flexibility, as policyholders receive a lump sum payout that they can allocate as needed.

- Premium costs: Policies for critical conditions often have lower premiums compared to comprehensive health insurance for parents, especially if the coverage is limited to specific conditions. However, critical illness insurance does not cover general healthcare needs, so pairing it with a standard health policy is advisable.

- Waiting periods and exclusions: Like standard health policies, critical illness coverage usually has specific waiting periods and exclusions for certain illnesses. Reviewing these details ensures the policy aligns with your family’s health history and potential risks.

- Financial support for family members: Health insurance for parents covers day-to-day medical needs and can be renewed annually, while critical illness insurance provides long-term support during severe health crises. Combining both types of insurance offers a balanced approach to managing healthcare costs.

Selecting the right policy for ageing parents

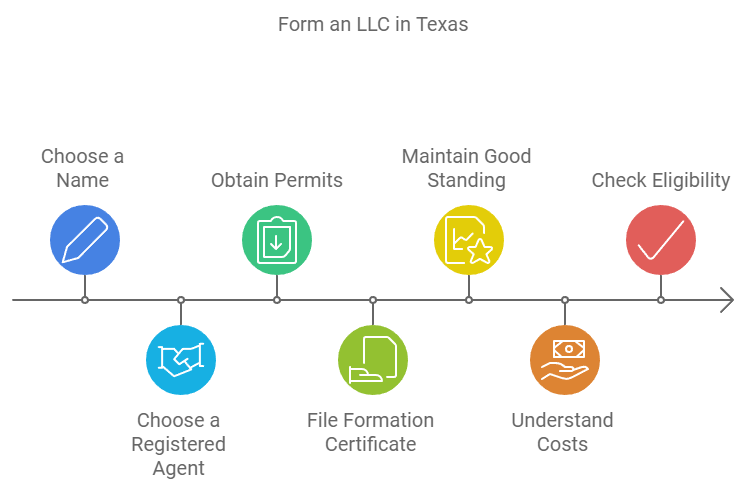

Choosing the right insurance coverage for parents involves careful consideration of their health needs and financial requirements. Here are some tips to help in the selection process:

- Assess health risks: Evaluate the specific health risks your parents face, including any pre-existing conditions or family history of critical illnesses. This assessment will help determine the need for comprehensive coverage.

- Compare policy features: Review the list of covered illnesses, payout structure, and waiting periods across different providers. Choosing a plan with flexible usage of funds and extensive coverage can offer greater peace of mind.

- Consider policy combinations: Combining critical illness insurance with health insurance for parents provides a well-rounded safety net, covering both routine and severe health needs.

- Check premium and affordability: Review the premium costs and select a plan that fits within the family budget. Policies with affordable premiums can complement standard health insurance without placing excessive financial strain on the family.

Conclusion

In 2025, coverage for critical illnesses serves as a vital tool for families looking to safeguard their finances during life-threatening health conditions. By providing a lump sum benefit for severe illnesses, this insurance offers flexibility and financial support when it’s needed most. For families with ageing parents, combining this specialised coverage with health insurance for parents ensures comprehensive protection that addresses both everyday and critical healthcare needs.

As healthcare expenses continue to rise, choosing the right insurance becomes essential. With careful planning and an understanding of policy features, families can secure the best possible protection for their loved ones, ensuring financial stability and access to high-quality care during challenging times.

1 Comment

[…] Read more: Critical health insurance […]

Comments are closed.