The United Kingdom aerospace carbon fibre market size is assessed to grow at a compound annual growth rate (CAGR) of 8.3% between 2025 and 2034. The market is being aided by the robust growth of the aerospace sector and the growing focus on boosting the sustainability of aircraft. Carbon fibre, known for its lightweight, strength, and durability, is increasingly being adopted in the aerospace industry to enhance fuel efficiency and reduce emissions. As the global demand for more efficient and environmentally friendly aircraft rises, carbon fibre is becoming an essential material for aerospace manufacturers.

In this blog post, we will explore the key factors driving the growth of the aerospace carbon fibre market in the UK, delve into market segmentation, and examine the trends shaping the future of this critical material in the aerospace sector.

The Role of Carbon Fibre in the Aerospace Industry

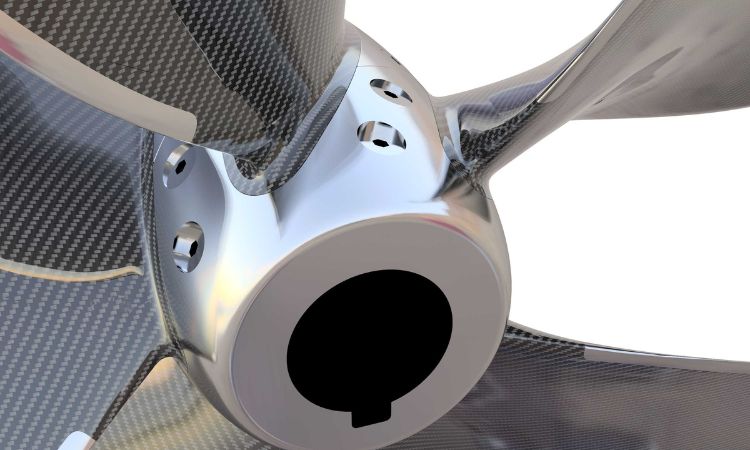

Carbon fibre is a composite material known for its exceptional strength-to-weight ratio, corrosion resistance, and high fatigue tolerance. In the aerospace industry, these qualities make it ideal for producing aircraft components that are both lightweight and strong, leading to improvements in fuel efficiency, durability, and overall performance. The use of carbon fibre in the aerospace sector is not new, but its adoption has significantly increased in recent years due to the growing demand for sustainable aviation solutions.

The increasing pressure on the aerospace industry to reduce carbon emissions has led to a shift towards materials like carbon fibre, which help in reducing the weight of aircraft. This, in turn, reduces fuel consumption and minimizes environmental impact. In the UK, a leader in aerospace technology and innovation, the demand for carbon fibre in both commercial and military aviation is rising as manufacturers seek to improve the efficiency and sustainability of their aircraft.

Market Segmentation: Key Drivers of Growth

The UK aerospace carbon fibre market can be segmented based on material type, carbon fibre form, application, and end-use. These segments provide insights into the diverse ways carbon fibre is being used across various aerospace applications, driving growth in the industry.

By Material: Pan-Based vs. Pitch-Based Carbon Fibre

- Pan-Based Carbon Fibre

Pan-based carbon fibre is derived from polyacrylonitrile (PAN) precursors. It is the most widely used form of carbon fibre in the aerospace industry due to its high tensile strength and versatility. In the UK, Pan-based carbon fibre is primarily used in commercial aircraft, military aircraft, and other critical applications where performance, weight reduction, and durability are key.- Market Trends: The demand for Pan-based carbon fibre is growing as more aerospace manufacturers seek cost-effective, lightweight materials for aircraft construction.

- Pitch-Based Carbon Fibre

Pitch-based carbon fibre is made from petroleum or coal tar pitch. It is known for its high thermal and electrical conductivity but is less commonly used in the aerospace sector compared to Pan-based fibre. However, in specific applications such as the construction of high-performance aircraft parts, pitch-based carbon fibre is still preferred due to its superior properties in thermal resistance and performance under extreme conditions.- Market Trends: Although niche, pitch-based carbon fibre is experiencing steady demand in military and specialized aerospace applications.

By Type: Continuous, Long, and Short Carbon Fibre

- Continuous Carbon Fibre

Continuous carbon fibre is one of the most popular types of carbon fibre used in aerospace applications due to its ability to create longer, uninterrupted fibre lengths. This type of fibre is often used in structural components such as fuselage panels, wings, and tail sections, where strength and durability are essential.- Market Trends: With the rise in demand for lightweight aircraft, continuous carbon fibre is poised to see significant growth in the UK market, particularly in the commercial aviation sector.

- Long Carbon Fibre

Long carbon fibres are used in various aerospace components where strength and length are required, but the continuous form is not necessary. These fibres are often incorporated into composite materials to create parts that are strong yet cost-effective.- Market Trends: The use of long carbon fibres is increasing in both commercial and military applications as they offer a balance between strength, flexibility, and cost.

- Short Carbon Fibre

Short carbon fibres are primarily used in injection-molded parts or in applications where the form of the fibre doesn’t need to be continuous. While they are not typically used in structural components, they are ideal for secondary components like internal fittings and small mechanical parts.- Market Trends: Short carbon fibres are finding applications in low-cost, high-volume production for commercial aircraft interiors and other non-structural components.

By Application: Interior vs. Exterior Components

- Interior Applications

Carbon fibre is increasingly being used in the interior of aircraft to reduce weight while maintaining high levels of durability and aesthetic appeal. Applications include seating, flooring, and cabin panels. Carbon fibre’s lightweight nature helps reduce the overall weight of the aircraft, leading to fuel savings over time.- Market Trends: The trend toward luxury and premium-class seating in commercial aircraft is pushing the demand for carbon fibre components in the interior.

- Exterior Applications

Carbon fibre is extensively used in the exterior of aircraft, including wings, fuselage, and tail sections. By reducing the weight of these large components, carbon fibre contributes significantly to improving fuel efficiency and overall aircraft performance.- Market Trends: As aerospace manufacturers strive to meet environmental targets, the use of carbon fibre in exterior applications is expected to increase, particularly in military fixed-wing aircraft and next-generation commercial jets.

By End-Use: Commercial, Military, and Other Sectors

- Commercial Aircraft

The commercial aviation sector remains the largest end-user of carbon fibre in the UK. Airlines and manufacturers are increasingly adopting carbon fibre in their fleets to reduce operating costs, improve fuel efficiency, and meet stringent emissions standards. The growth of low-cost carriers and a rising demand for fuel-efficient aircraft are significant drivers of this segment.- Market Trends: The ongoing development of next-generation aircraft like the Boeing 787 and Airbus A350, which incorporate substantial amounts of carbon fibre, is boosting market growth.

- Military Fixed-Wing Aircraft

Carbon fibre is extensively used in military fixed-wing aircraft to enhance performance, reduce weight, and improve fuel efficiency. In the UK, military investment in advanced aerospace technologies is accelerating the demand for high-performance materials such as carbon fibre.- Market Trends: With increasing defense budgets and a focus on stealth and high-performance aircraft, the use of carbon fibre in military applications is expected to see steady growth.

- Other Applications

Carbon fibre is also used in emerging aerospace sectors, such as drone manufacturing, small aircraft, and electric vertical take-off and landing (eVTOL) aircraft. As these markets mature, they are expected to drive further demand for lightweight, strong materials like carbon fibre.- Market Trends: The rapid growth of unmanned aerial vehicles (UAVs) and electric aviation is expected to create new opportunities for carbon fibre manufacturers.

Market Dynamics: Key Drivers and Challenges

Drivers of Growth

- Demand for Lightweight, Fuel-Efficient Aircraft

The global aviation industry is under immense pressure to reduce its carbon footprint. Carbon fibre’s lightweight properties contribute to fuel savings, making it an essential material in the development of more sustainable aircraft. - Technological Advancements in Carbon Fibre Production

Innovations in carbon fibre manufacturing processes are driving down costs and making carbon fibre more accessible to aerospace manufacturers. New techniques such as automated fiber placement (AFP) and resin transfer molding (RTM) are improving efficiency and cost-effectiveness. - Government Regulations and Environmental Pressures

Stricter emissions regulations and growing environmental concerns are forcing the aerospace sector to adopt sustainable materials like carbon fibre. The UK government’s focus on reducing aviation emissions and encouraging green technologies further supports the demand for carbon fibre in aerospace.

Challenges

- High Production Costs

Despite ongoing advancements, carbon fibre production remains expensive, which can hinder its widespread adoption in low-cost aerospace components. This cost barrier is a significant challenge for manufacturers looking to scale up production. - Material Availability and Supply Chain Issues

The complexity of carbon fibre manufacturing and the reliance on raw materials like petroleum and natural gas pose supply chain challenges, which can lead to production delays and increased costs. - Competition from Alternative Materials

Other lightweight materials, such as titanium and aluminum alloys, present competition to carbon fibre in certain aerospace applications. Balancing the cost and performance advantages of carbon fibre with these alternatives is an ongoing challenge for manufacturers.

Competitive Landscape: Key Players and Strategies

The UK aerospace carbon fibre market is highly competitive, with several global players leading the charge in innovation and market expansion. Key companies in this space include Hexcel Corporation, Toray Industries, SGL Carbon, Teijin Limited, and Cytec Solvay Group.

These companies are investing heavily in research and development to improve the performance and reduce the costs of carbon fibre materials. Strategic partnerships, mergers, and acquisitions are common in the industry, as manufacturers aim to enhance their capabilities and expand their product portfolios.