The world of digital finance is exploding, and Real World asset tokenization services in usa is emerging as one of its most powerful innovations. As traditional assets—from real estate and commodities to art and equity—are transformed into blockchain-based tokens, businesses and investors alike are capitalizing on the new wave of decentralization and digitization.

However, launching a successful asset tokenization platform isn’t something you do on a whim. You need a reliable and experienced development partner who understands the complexity of blockchain, security, compliance, and user experience. In this blog, we’ll walk you through how to start smart and choose the right asset tokenization development company to drive your project to success.

What is Asset Tokenization?

Asset tokenization refers to the process of converting ownership rights in real-world assets into digital tokens using blockchain technology. These tokens represent legal ownership and can be traded, sold, or held just like traditional securities—but with greater efficiency, transparency, and accessibility.

Benefits of Asset Tokenization:

- Fractional ownership: Make high-value assets more accessible

- Liquidity: Create 24/7 tradable assets in secondary markets

- Transparency: Maintain immutable transaction records

- Cost-efficiency: Reduce intermediary fees and settlement times

Whether you’re in real estate, finance, art, or energy, tokenization can revolutionize how you raise capital and interact with investors.

Why Partnering with the Right Company Matters

A high-functioning asset tokenization platform requires much more than just blockchain coding. You need a development partner with:

- Technical blockchain expertise

- Smart contract development and audit capabilities

- Strong knowledge of global compliance regulations

- Experience in real-world asset tokenization services

- Post-launch support and maintenance

A poor development choice could lead to security vulnerabilities, regulatory issues, or an unusable platform. Choosing a trusted asset tokenization development company ensures your project starts—and stays—on the right track.

Key Features Your Platform Must Have

Before diving into vendor selection, it’s crucial to understand the core features your asset tokenization platform should support:

1. Token Creation Engine

Support for multiple token standards (ERC-20, ERC-721, ERC-1400) to represent different asset classes.

2. Compliance Automation

Built-in modules for KYC/AML, jurisdiction checks, and legal recordkeeping.

3. Smart Contracts

Automate ownership transfers, dividend distributions, and governance rights.

4. Investor Dashboard

Real-time insights, portfolio management, and asset tracking.

5. Secure Wallet Integration

Multi-signature wallets and cold storage options to protect investor assets.

6. Liquidity Support

Integration with centralized and decentralized exchanges to allow for token trading.

The right development partner will understand the importance of each of these and be able to tailor them to your project.

How to Select the Right Asset Tokenization Development Partner

Step 1: Define Your Business Goals

Clarify what assets you plan to tokenize and your target market. Are you focused on real estate, startup equity, carbon credits, or collectibles? Having a clearly defined use case helps the development team design the best solution.

Step 2: Evaluate Technical Experience

Look for a company that has deep experience in blockchain development and asset tokenization platform development. They should have a strong portfolio that includes real-world projects in:

- Ethereum, Polygon, BNB Chain, or Solana ecosystems

- Smart contract coding and auditing

- Wallet and exchange integration

Ask for demos, whitepapers, and case studies to verify their capabilities.

Step 3: Assess Regulatory Understanding

Legal compliance is one of the most critical factors in tokenizing assets. Your development partner should be familiar with:

- Global KYC/AML regulations

- Securities laws in your jurisdiction

- GDPR, CCPA, and other data protection laws

If they can’t speak confidently about legal compliance, move on.

Step 4: Understand Their Development Process

A reliable asset tokenization development company will follow a structured and transparent process, typically including:

- Project discovery and consultation

- UX/UI wireframing and design

- Smart contract creation and auditing

- Platform development and QA testing

- Launch support and post-deployment maintenance

Step 5: Compare Pricing and Support Options

Look for a partner that offers:

- Transparent pricing (fixed rate, hourly, or milestone-based)

- No hidden charges

- Long-term maintenance and upgrade packages

Avoid companies that don’t provide post-launch support—it’s essential for security, bug fixes, and feature enhancements.

Questions to Ask Your Potential Development Partner

- Can you share recent examples of asset tokenization platforms you’ve built?

- What blockchain technologies and token standards do you specialize in?

- How do you handle smart contract audits and security testing?

- What legal or compliance services do you offer or partner with?

- How do you manage ongoing platform updates and bug fixes?

The answers to these questions will help you gauge the company’s experience, professionalism, and alignment with your business vision.

Common Pitfalls to Avoid

Lack of Compliance Focus

A developer who dismisses legal and regulatory concerns is a liability.

One-Size-Fits-All Solutions

Every asset and business model is different—avoid cookie-cutter platforms.

No Scalability Plan

If your platform isn’t built for future growth, you’ll hit a wall quickly.

No Client References

If they can’t provide past client contacts, consider it a red flag.

Future of Asset Tokenization Platforms

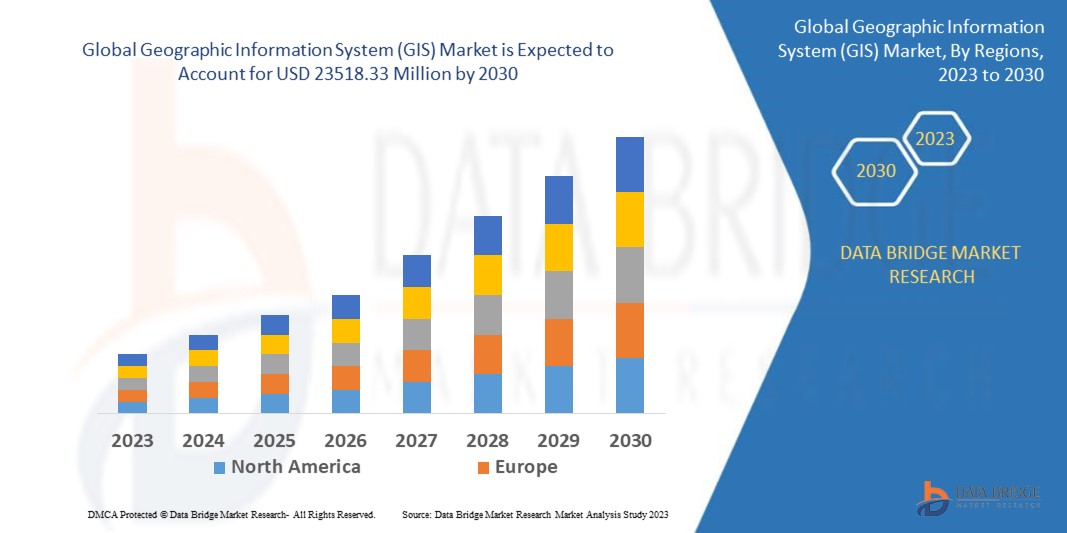

The global market for tokenized assets is projected to exceed $16 trillion by 2030. Businesses that embrace asset tokenization early are setting themselves up for:

- Faster fundraising cycles

- Broader investor reach

- Enhanced liquidity and asset visibility

- First-mover advantage in a growing market

By choosing the right asset tokenization services provider, you position your brand as a leader in the financial future.

Conclusion

Selecting the right partner for asset tokenization platform development is not just a technical decision—it’s a strategic one. The ideal partner brings together blockchain expertise, regulatory understanding, top-tier security practices, and a track record of successful launches.

By following this roadmap, you can start smart and ensure that your project not only meets current market demands but is also built to adapt and scale into the future.

Ready to launch your asset tokenization platform? Choose a development partner that understands your vision and has the tools to bring it to life.

Pro Tip: Start by scheduling a free consultation with a leading asset tokenization development company. You’ll get insights, technical feedback, and the confidence to move forward with your project!