Managing payroll can be tricky, especially when pay stub errors creep in. These mistakes might seem small but can create big problems for employees and employers. From incorrect tax deductions to miscalculated overtime, such issues can lead to financial loss, compliance troubles, and strained trust.

This is where machine learning steps in. With its ability to process and analyze large amounts of data, machine learning is revolutionizing payroll systems by identifying errors that humans might miss. In this blog, we’ll explore how machine learning works to detect mistakes in pay stub data and how you can pair it with tools like free paystub makers to improve payroll accuracy.

What Are Pay Stub Errors?

Before diving into the tech side of things, let’s clarify what pay stub errors look like:

- Wrong Tax Deductions: Incorrect tax amounts can lead to overpayment or penalties during audits.

- Missed Hours: An employee’s pay might not reflect their actual hours worked.

- Misreported Benefits: Errors in calculating insurance, retirement contributions, or other benefits can cause confusion.

- Duplicate Payments: Paying the same amount twice by mistake.

Detecting these issues early ensures payroll accuracy and saves both time and money.

How Does Machine Learning Work in Payroll?

Machine learning is a type of artificial intelligence (AI) that learns from patterns in data. When applied to payroll, it scans through pay stub records to detect anything unusual.

Here’s how it works:

1. Spotting Patterns:

Machine learning algorithms analyze thousands of pay stubs to understand what “normal” looks like. This includes regular hours worked, typical deductions, and bonus amounts.

2. Identifying Outliers:

If something seems off—like a sudden increase in hours worked or a missing deduction—the system flags it as a potential error.

3. Constant Learning:

The system improves over time by learning from new data. As your payroll changes or expands, machine learning adapts to those shifts.

For businesses that frequently need to generate pay stubs, this technology ensures mistakes are caught before they become major problems.

The Power of Machine Learning and Free Paystub Makers

If you’re a small business owner or freelancer, chances are you’ve used a free paystub maker. These tools let you create pay stubs by simply entering details like hours worked, salary, and deductions.

When paired with machine learning, paystub makers become even more powerful. Machine learning checks the data you input, ensuring calculations are correct and nothing looks unusual.

For example, imagine entering an employee’s overtime hours into a paystub maker. If the hours seem unusually high, machine learning will flag the entry for review. This added layer of protection ensures you’re not overpaying or misreporting payroll details.

Why Machine Learning Matters in Payroll

Mistakes in payroll don’t just cause headaches—they can have serious consequences. Here are some reasons why machine learning is a game-changer:

- Saves Time: Manually reviewing pay stubs for errors can take hours. Machine learning does it in seconds.

- Prevents Compliance Issues: Ensuring accuracy helps businesses stay in line with labor laws and tax requirements.

- Builds Trust: Employees rely on accurate paychecks. Consistently error-free payroll builds trust between employers and staff.

- Reduces Costs: Avoiding mistakes means fewer fines, audits, or costly payroll adjustments.

For businesses looking to keep things simple and efficient, combining machine learning with a free paystub maker can make a big difference.

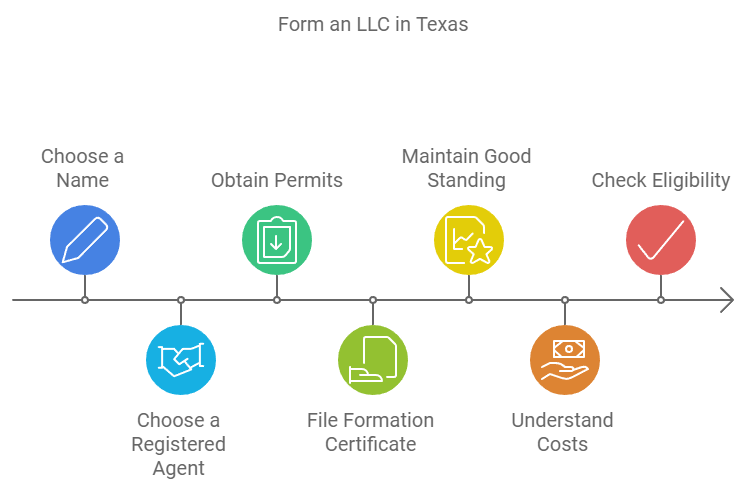

Steps to Use Machine Learning for Pay Stub Accuracy

Getting started with machine learning for payroll doesn’t have to be complicated. Here’s a simple plan:

- Collect Your Data: Start by gathering accurate records of past payroll, including pay rates, deductions, and benefits.

- Pick the Right Tools: Choose payroll software or a free paystub maker that supports machine learning integration.

- Set Up Anomaly Detection: Many tools offer features where machine learning automatically flags potential issues.

- Regularly Update the System: Ensure the system stays current with tax laws and payroll rules.

- Review Alerts: Check flagged entries to confirm if they are actual errors or just unusual entries.

Overcoming Challenges

No system is perfect, and machine learning comes with its own challenges. For instance, it relies on accurate input data. Feeding incorrect information into the system could lead to false alerts.

Additionally, small businesses might worry about costs. However, many payroll tools, including free paystub makers, now offer affordable ways to integrate machine learning.

Conclusion

Payroll accuracy is essential, and machine learning is making it easier than ever to detect errors in pay stub data. By analyzing patterns, flagging anomalies, and learning from past mistakes, this technology ensures you can manage payroll with confidence.

Pairing machine learning with simple tools like free paystub makers is a smart way to reduce errors, save time, and build trust with your employees. Whether you’re a small business or a growing company, these tools are invaluable for staying on top of payroll tasks.