When it comes to buying, selling, or investing in real estate, understanding the true value of a property is essential. A reliable property valuation can guide your decision-making and ensure you’re making sound investments. In a city like Dubai, where the real estate market is dynamic and fast-paced, selecting the right property valuation company is crucial to achieving the best outcomes. This guide will help you navigate the process of choosing the right property valuation company in Dubai and ensure you’re getting expert advice that meets your needs.

1. Understand the Importance of Property Valuation

Property valuation is more than just determining the price of a property; it involves assessing various factors that contribute to its market value, such as location, condition, market trends, and potential for future growth. Accurate property valuations are essential whether you’re looking to buy a home, sell your property, or assess the value of a commercial building for investment purposes.

A professional property valuation company in Dubai will provide you with an in-depth analysis of the property, helping you understand not only its current market value but also any potential risks or opportunities.

2. Check for Certification and Accreditation

In a fast-growing market like Dubai, the accuracy of property valuations is critical. One of the first things you should check when choosing a property valuation company in Dubai is whether they are certified and accredited by relevant authorities. These credentials ensure that the company adheres to established industry standards and guidelines.

Look for certifications from organizations such as the RICS (Royal Institution of Chartered Surveyors) or local bodies like the Dubai Land Department (DLD). These qualifications signify that the company’s values are skilled professionals who use proven methodologies to assess property values, giving you peace of mind that the valuation is accurate and credible.

3. Experience and Expertise in the Dubai Market

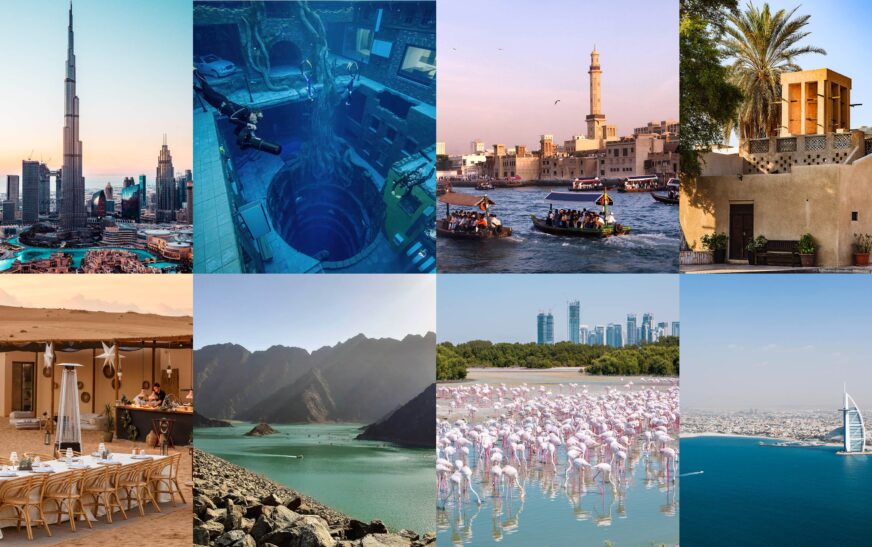

Dubai’s property market is unique and constantly evolving, with various factors influencing property values. Therefore, it’s essential to choose a property valuation company in Dubai that has in-depth knowledge of the local market. A company with experience in the Dubai real estate market will have a better understanding of regional trends, demand, and supply fluctuations, which can greatly impact property prices.

When evaluating a property valuation service, inquire about their experience in handling similar types of properties—whether residential, commercial, or industrial. A company with a diverse portfolio will be better equipped to assess a variety of properties accurately and provide comprehensive valuations. To better understand property valuation’s importance, you can check the article what is a property valuation and why is it important? This comprehensive guide will deepen your understanding of the nuances of property valuation and why it’s a vital tool in real estate transactions.

4. Look for Transparent and Detailed Reports

A reliable property valuation company should provide you with a detailed, transparent report outlining the factors that have contributed to the property’s valuation. This should include data on recent comparable sales, market trends, the property’s condition, and any additional external factors that could affect its value.

Transparency is key, so ensure that the valuation company offers clear explanations of their methodologies and conclusions. This will give you a better understanding of how the valuation was determined and provide valuable insights into the property’s future potential.

5. Consider Technology and Tools Used

In today’s digital age, the use of advanced technology can enhance the accuracy of property valuations. Many property valuation companies now use state-of-the-art software and analytical tools that help them assess market trends, compare sales data, and predict future property values with greater precision.

When selecting a property valuation company in Dubai, ask about the technology and tools they use. Companies that invest in the latest technology are more likely to provide accurate, up-to-date valuations that reflect the current market conditions.

6. Assess Customer Service and Communication

The property valuation process should be as transparent and straightforward as possible. A professional company will guide you through each step of the process and be available to answer any questions you have. Strong communication skills are essential, as you’ll want to be kept informed about the progress of your valuation and any findings.

Check online reviews and testimonials from previous clients to gauge the level of customer service provided by the valuation company. A responsive and helpful team is more likely to make the process smoother and ensure you feel confident in your property decision.

7. Evaluate Pricing and Value for Money

While it’s tempting to choose the cheapest option, remember that property valuation is an investment in your real estate decision-making. Opting for the most affordable service may not always provide you with the most accurate or comprehensive valuation. However, this doesn’t mean you need to go for the most expensive option either.

Look for property valuation services in Dubai that offer a fair pricing structure based on the quality of their service. Ensure the company provides a detailed breakdown of costs, so you understand what you’re paying for and can assess the value for money provided.

Conclusion

Choosing the right property valuation company in Dubai is a critical step toward making informed real estate decisions. By ensuring the company is certified, experienced, and equipped with the right technology, you can trust that the valuation you receive will be accurate and reliable.