For businesses of all sizes, maintaining accurate financial records is crucial. This is especially true when it comes to employee payroll, as mistakes can lead to serious issues such as tax penalties or disgruntled employees. One tool that’s becoming increasingly popular for ensuring accurate payroll record-keeping is the check stub maker. A check stub maker is a digital tool that generates pay stubs, which provide a detailed breakdown of an employee’s earnings, deductions, and net pay. In this blog, we will explore how using a check stub maker can help businesses maintain accurate payroll records and why this is so important.

What is a Check Stub Maker?

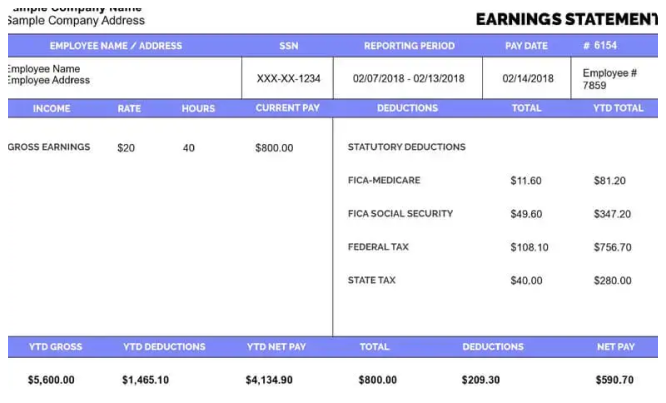

Before we dive into the benefits, let’s define what a check stub maker is. A check stub maker is an online or software-based tool that allows employers to create pay stubs for their employees. These pay stubs are essential documents that show the gross pay, deductions (like taxes, insurance, and retirement contributions), and the net pay (the amount the employee takes home).

The tool can be used for any type of employment: full-time, part-time, hourly, or salaried employees. Check stub makers are particularly useful for small business owners, freelancers, and startups, where payroll might be handled by one person or a small team. It helps streamline the payroll process and ensures that records are up-to-date and accurate.

Why Accurate Record-Keeping Matters

Accurate record-keeping is not just about avoiding mistakes—it’s also about staying compliant with the law and building trust with employees. Here are a few reasons why accurate payroll records are essential:

- Legal Compliance: Payroll records are required by the IRS, the Department of Labor (DOL), and other regulatory bodies. These records must be retained for a specified period (usually three to seven years) for auditing purposes. Failing to maintain accurate records can lead to fines, penalties, and audits.

- Employee Trust: Employees depend on accurate pay stubs to ensure they are being compensated fairly. Mistakes or inconsistencies in payroll can lead to dissatisfaction, complaints, and even legal action. Providing clear, accurate pay stubs helps maintain positive employee relations.

- Tax Purposes: Accurate payroll records are essential during tax season. Both employees and employers need precise records to report income and deductions. This helps avoid overpayment or underpayment of taxes, which could lead to penalties.

- Financial Planning: Both employers and employees need clear records to plan financially. For employers, knowing exactly how much to allocate for payroll expenses is crucial for budgeting. For employees, pay stubs show how much they earn, allowing them to make informed financial decisions.

Don’t Miss: Free Paystub Generator

How Check Stub Makers Ensure Accurate Record-Keeping

Now that we understand the importance of accurate record-keeping, let’s look at how check stub makers can help.

1. Simplified Calculations

One of the main challenges when managing payroll manually is performing calculations accurately. With a check stub maker, the tool automatically calculates gross pay, taxes, deductions, and net pay based on the data entered. By inputting basic information such as the employee’s hourly rate or salary, number of hours worked, and applicable tax rates, the software does the math for you. This reduces human error and ensures that all deductions are calculated according to the latest tax laws.

2. Consistency Across Pay Periods

Whether you’re processing weekly, bi-weekly, or monthly payroll, a check stub maker ensures that the format and information remain consistent across all pay periods. Consistent formatting makes it easier to track pay over time and helps both employers and employees compare earnings and deductions from one period to the next.

This consistency also ensures that no key information is overlooked. With every pay stub generated, the same fields will be populated, ensuring nothing important is missed, like overtime pay, sick leave, or bonus payments.

3. Real-Time Updates

A good check stub maker is updated in real-time to reflect the latest tax laws and employment regulations. This is especially important because tax rates and deduction percentages can change frequently. When these updates are integrated into the system, employers don’t have to worry about making manual changes to comply with new laws—they simply use the tool as usual, knowing it’s up-to-date.

This is especially valuable during tax season when businesses need to ensure they are withholding the right amounts for federal, state, and local taxes. A check stub maker ensures that the correct amounts are deducted based on the employee’s location and job classification.

4. Detailed Pay Stubs with Clear Breakdown

A key feature of any check stub maker is the level of detail it provides in each pay stub. The tool generates clear, professional-looking pay stubs that display a breakdown of all the relevant payroll information. This includes:

- Gross Pay: The total amount earned before any deductions.

- Deductions: Taxes (federal, state, local), retirement contributions, health insurance premiums, and other voluntary deductions.

- Net Pay: The final amount that the employee takes home after all deductions are subtracted.

Having a detailed pay stub ensures that employees can easily verify that their pay is correct. It also helps employers keep a record of all deductions for their accounting and tax purposes. By using a check stub maker, businesses ensure that all the necessary details are included and that the records are clear and legible.

5. Secure and Accessible Records

With a check stub maker, pay stubs are usually stored digitally, which means they can be accessed and downloaded at any time. This eliminates the need for paper records, which can be lost or damaged. Digital records are much easier to organize, search, and store.

In addition, many check stub makers offer security features such as password protection and encrypted files to protect sensitive employee data. This is particularly important for maintaining privacy and ensuring compliance with data protection laws.

6. Audit-Ready Records

Having an audit-ready record system is essential for businesses, especially during tax season or if the IRS comes calling. By using a check stub maker, companies can generate accurate records quickly, which can be useful for audits. Each pay stub generated can be stored in an organized manner, making it easier to retrieve information if needed. This ensures that employers are prepared in case they are ever audited, minimizing the risk of penalties.

7. Employee Access and Transparency

Check stub makers often offer features that allow employees to access their pay stubs online through secure portals. This provides employees with transparency into their earnings and deductions, allowing them to keep track of their pay history. Employees can also download and print their pay stubs for personal record-keeping or tax purposes.

This transparency can reduce disputes and misunderstandings between employees and employers. If an employee ever questions a deduction, they can quickly refer to their pay stub for clarification.

Conclusion

Accurate record-keeping is essential for any business, and payroll records are no exception. With a check stub maker, businesses can streamline the payroll process, reduce errors, and ensure compliance with tax laws and regulations. By automating calculations, ensuring consistency, and providing detailed and accessible records, check stub makers help businesses keep their payroll systems running smoothly.

For employers, the Free check stub maker is a valuable tool that ensures employees are paid accurately, on time, and in a transparent manner. For employees, it offers a clear view of their earnings and deductions, building trust with the employer and helping to avoid disputes.

By incorporating a check stub maker into your payroll system, you can ensure accurate, organized, and easily accessible payroll records, making it easier to manage your business’s finances and keep your employees happy.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown