The very nature of the stock market is a volatile one. With constant price fluctuations making it near impossible for investors to gain significant returns, trading can become quite tricky.

However, what if we told you that there are specific investment choices that you can make that can enable you to lock down a particular price for an asset for a future purchase, that will remain unaffected by the market fluctuations?

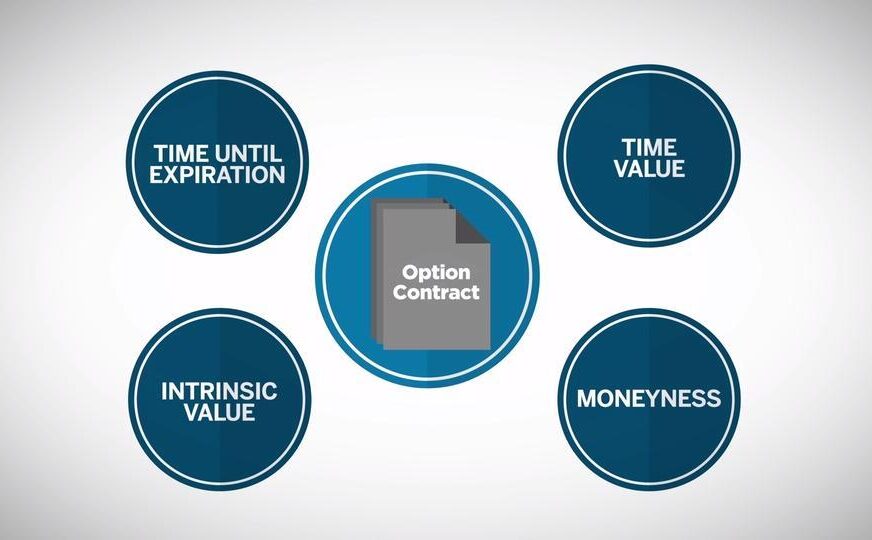

That is where an option contract comes into the picture. Here, we will take a look at everything you need to know about these derivative contracts and how they can help investors earn significant returns.

Understanding an Options Contract

The option contract is a type of derivative contract in the stock market and works as an agreement between two parties. With the help of an option contract, an investor has the right to buy or sell an underlying asset, at a fixed price.

This price is also known as the strike price and the buying and selling needs to be carried out on or before the predetermined expiry date of the option.

However, the trader who has the right to buy or sell the option is not under an obligation to do so. It’s possible to buy options contracts to speculate on stocks or to sell them to generate income.

Option contracts can hold different types of assets under them including stocks, commodities, bonds, etc. The main purpose of using options by traders is to hedge themselves against potential risks.

Working Of an Options Contract

Listed below is a step-by-step working of an option contract:

- Party 1 makes an offer, agreeing that said offer will stay open for a certain period.

- Party 1 and Party 2 together agree on the expiration date of the contract and the strike price at which the buyer will purchase the asset before the expiry

- The option buyer then pays an option premium to the option seller/writer The buyer of the option pays a premium

- The option premium is a sure-shot earning for the option seller, notwithstanding what happens with the contract after that point.

- Post the purchase of the option contract, the buyer gains the right to buy or sell the underlying asset at the strike price without the obligation to do so.

- However, if the option buyer chooses to execute the option contract, the option seller is bound to do as the buyer wants.

Types of Option Contracts

There are two types of option contacts; put and call options. Listed below is a detailed description of both of them.

-

Call option

- Call options work best for investors or traders who are looking to buy underlying assets at the strike price.

- Buyers can purchase the option by paying a premium to the option seller,

- The paying of the premium grants the right to sell the assets to the option buyer without the obligation to do so.

- The selling itself, however, open trading account has to be done by the option seller, if the option buyer decides to exercise the contract.

- When the underlying asset’s price increases, the value of the call option also.

-

Put option

- Think of the put option contract as the opposite of a call option contract.

- Here, the buyer purchases a put option contract when they see the potential for the underlying asset’s price to fall

- This leads to an increase in the value of the put option.

- The option buyer gains the right to sell the underlying asset at the strike price

- If the market price or spot price of the underlying asset is less than the strike price before or on expiration, the buyer can assign the purchase obligation to the option seller at the strike price.

Conclusion

The option contract is a versatile contract that helps investors hedge against potential risks due to market fluctuations and gain significant returns when and if exercised.