Forming a business requires careful consideration of its structure, liability, and long-term growth. Across the United States, entrepreneurs often consider a Limited Liability Company (LLC) because it blends the liability protection of a corporation with the flexibility of a partnership. In Texas, LLCs have gained significant popularity, primarily due to the state’s pro-business environment, fewer regulatory hurdles, and tax advantages. Understanding what an LLC is and why so many Texans choose this structure can help new business owners decide whether it is right for them.

Understanding the Basics of an LLC

An LLC is a business entity that shields its owners, called members, from being personally liable for the company’s debts. In practice, this means that if the company faces lawsuits or financial obligations, members’ personal assets, such as homes or personal savings, are typically protected. At the same time, an LLC avoids many of the formalities that corporations must follow, such as holding annual shareholder meetings and maintaining extensive corporate records.

This balance between legal protection and operational flexibility makes the LLC a strong option for both small businesses and growing enterprises.

Why LLCs Are Attractive in Texas

Texas consistently ranks among the top states to start a business. The appeal of LLCs in Texas comes down to several practical reasons:

- No state income tax: Texas does not impose a personal income tax, which benefits individuals when business profits are passed through to their individual tax returns.

- Simplified compliance: Compared to other states, Texas maintains fewer regulatory burdens for LLCs. This makes ongoing compliance easier, especially for small business owners.

- Credibility: Operating as an LLC can enhance a company’s reputation by showing clients, partners, and lenders that the business is formally structured.

- Flexibility in management: Texas LLCs can be either member-managed or manager-managed, allowing owners to control how day-to-day decisions are made.

These points illustrate why many entrepreneurs consider Texas one of the most business-friendly states in the country.

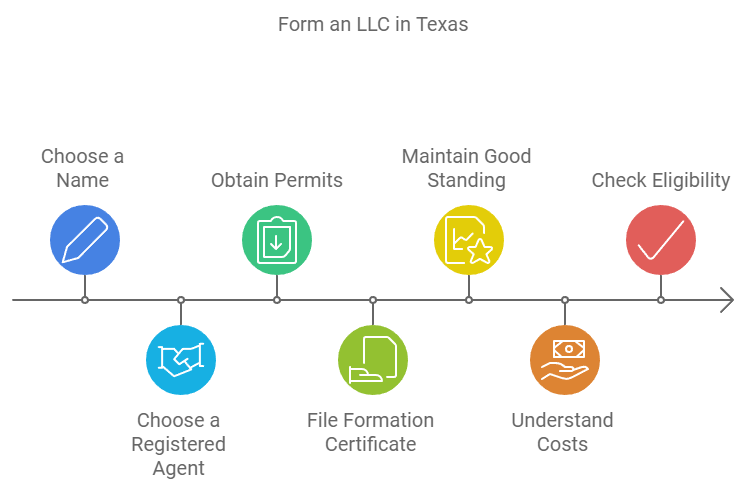

Steps Involved in Forming an LLC in Texas

Entrepreneurs often ask about the process of how to open an LLC in Texas. The state has set clear steps that guide new business owners:

- Choose a business name: The name must be unique and comply with Texas naming rules.

- File a Certificate of Formation: This official filing with the Texas Secretary of State establishes the LLC as a legally recognized entity.

- Appoint a registered agent: The agent serves as the company’s primary point of contact for legal matters.

- Create an operating agreement: Though not required by law, it outlines ownership, roles, and management rules.

- Obtain an EIN: The Employer Identification Number (EIN) is necessary for tax purposes and hiring employees, as required by the IRS.

Following these steps helps that an LLC is appropriately structured and compliant with Texas regulations from the outset.

Key Benefits Driving Popularity

While the basics are essential, the practical advantages of an LLC explain why this structure continues to dominate in Texas. Some of the most notable benefits include:

- Liability protection: Members are generally not held personally responsible for the company’s debts.

- Pass-through taxation: Profits are taxed only once, at the individual level, unlike corporations that face double taxation.

- Ease of formation and maintenance: Filing is straightforward, and annual requirements are minimal compared to other structures.

- Scalability: LLCs allow for multiple members, which is helpful as the business grows.

Altogether, these benefits provide entrepreneurs with both security and freedom, enabling them to focus on building their business without unnecessary administrative burdens.

Is an LLC the Right Choice for Every Business?

While LLCs offer numerous advantages, they may not be the ideal choice for every situation. For example, businesses seeking venture capital investment may find a corporation more appealing to investors. Likewise, sole proprietors with limited liability concerns might prefer to keep things simple without forming a separate entity.

The decision should be based on the type of business, growth expectations, and financial considerations. Consulting with legal or tax professionals can provide clarity before committing to a specific structure.

Conclusion

LLCs have become a favored business structure in Texas because they provide a blend of liability protection, tax benefits, and operational flexibility. The state’s supportive environment further adds to their appeal, making them a practical choice for entrepreneurs at different stages. By understanding the basics, recognizing the benefits, and learning the steps involved, business owners can make an informed decision about whether this structure is suitable for their needs. Choosing wisely from the start helps establish a solid foundation for long-term success.