In today’s fast-evolving digital world,Top Real Estate Tokenization Development Company in USA is creating massive buzz among savvy investors and tech-forward entrepreneurs. This innovative approach to property ownership leverages blockchain technology to create secure, smart, and scalable investment opportunities that were once limited to a small group of elite investors. Now, with real estate tokens, anyone with internet access can diversify their portfolio and tap into the lucrative real estate market — without the heavy lifting of traditional ownership.

In this blog, we’ll explore how real estate tokens are changing the game, the benefits of building your portfolio through tokenized assets, and what makes this trend a must-watch for 2025 and beyond.

What Are Real Estate Tokens?

Real estate tokens are digital representations of ownership in real property, issued and managed on a blockchain. These tokens can represent a fractional share in a single property or a diversified real estate fund, allowing multiple investors to own portions of high-value assets.

Unlike traditional real estate investments, tokenized assets bring instant liquidity, global accessibility, and transparent record-keeping to the forefront. Whether you’re a first-time investor or an institutional player, real estate tokenization opens the door to a more inclusive and dynamic marketplace.

Why Real Estate Tokenization Is Secure

Security is one of the key selling points of tokenized real estate. Through blockchain technology, all transactions are recorded on an immutable ledger — meaning once a record is made, it can’t be altered or deleted. This greatly reduces fraud, enhances transparency, and builds trust between all stakeholders.

Key Security Features:

- Smart contracts automate transactions and reduce human error.

- Immutable records ensure proof of ownership and transaction history.

- KYC/AML compliance helps platforms prevent fraud and verify investor identity.

- Decentralized systems eliminate single points of failure often present in traditional databases.

With robust cybersecurity protocols and encryption in place, real estate tokens are considered far more secure than paper-based deeds or manually managed systems.

How Real Estate Tokens Make Investing Smarter

Real estate tokenization isn’t just about cutting-edge tech — it’s also about making smarter investment decisions. Thanks to blockchain, data around properties, transactions, and performance metrics is more transparent, accessible, and real-time than ever before.

Smarter Investing Benefits:

- Real-time analytics and reporting give investors better insight into performance.

- Lower entry points allow for diversification across multiple properties.

- Global access means you can invest in international real estate from your smartphone.

- 24/7 trading on secondary markets allows you to buy or sell tokens at your convenience.

This smarter approach eliminates many of the headaches of traditional investing, such as paperwork, middlemen, and geographic limitations.

Scaling Your Portfolio Globally

One of the biggest advantages of real estate tokenization is its scalability. Traditional real estate investing requires substantial capital and often ties you to a single location or market. With tokenized assets, however, investors can scale their portfolio with fractional ownership in properties across the globe.

Imagine owning a stake in:

- A luxury condo in Dubai

- A commercial complex in New York

- A beachfront property in Bali

- —all through a few clicks on your digital wallet.

Scalable Investing Advantages:

- Fractional ownership reduces the need for large capital outlay.

- Global diversification reduces market risk.

- Automated asset management through smart contracts minimizes operational load.

- Platform interoperability means tokens can be bought and sold across various marketplaces.

Scalability allows everyday investors to build powerful portfolios that once were only accessible to large institutional players.

Use Cases of Real Estate Tokenization

This booming industry is already being leveraged by leading firms and investors worldwide. Some notable use cases include:

- Rental income distribution via smart contracts to token holders.

- Crowdfunded property development backed by blockchain.

- Instant property resale on global token exchanges.

- REITs (Real Estate Investment Trusts) transformed into liquid, tradable tokens.

Whether you’re a developer looking to raise capital or an investor looking for passive income and portfolio growth, real estate tokenization services can provide the tools and flexibility to succeed in today’s economy.

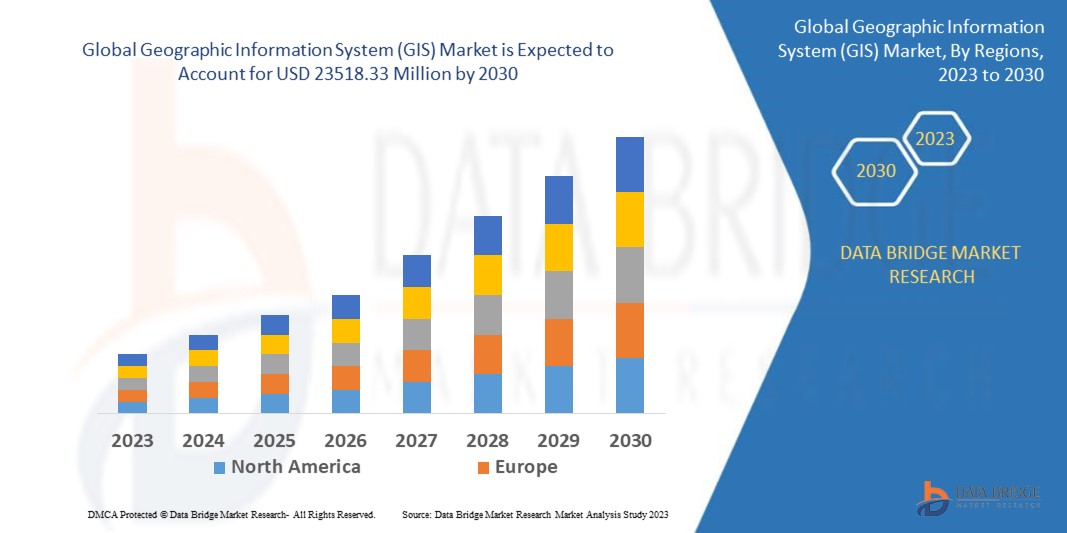

The Growing Market and Future Potential

According to market analysts, the tokenization of real-world assets — especially real estate — is projected to be a multi-trillion-dollar market in the coming years. With more real estate tokenization development companies entering the scene and governments slowly adopting supportive regulations, the infrastructure is being built for mainstream adoption.

Industry Trends to Watch:

- Integration with DeFi platforms for seamless lending and borrowing.

- Cross-chain tokenization enabling greater interoperability.

- AI-powered property analysis to optimize investment decisions.

- Regulatory clarity in regions like the US, EU, and UAE.

As tokenization becomes more regulated and technologically mature, expect to see it move from a niche offering to a foundational element of modern investment strategies.

How to Get Started

If you’re new to real estate tokenization, here are the steps to begin:

- Choose a trusted real estate tokenization platform with regulatory compliance.

- Complete KYC verification and create your digital wallet.

- Explore investment opportunities across various properties and locations.

- Buy tokens and track your investment in real-time.

- Earn passive income through rental yields and capital appreciation.

- Sell or trade tokens on secondary markets when you’re ready.

Always research the platform, review the property details, and ensure compliance with your region’s financial regulations before investing.

Final Thoughts

The world of real estate investment is undergoing a major transformation. With blockchain-powered real estate tokens, you can securely invest, smartly diversify, and scale your portfolio globally — all with lower risk and higher flexibility.

This is more than a passing trend. It’s the future of property ownership.

If you’re ready to break free from the limitations of traditional real estate, consider diving into tokenization. It’s secure, smart, and scalable — exactly what every modern investor needs.

Ready to start building your digital real estate empire?

Explore trusted real estate tokenization platforms today and take your first step toward smart, future-proof investing!

1 Comment

[…] estate tokenization is no longer just a buzzword—it’s a powerful investment strategy. With the right platform, you can access premium properties, earn passive income, and trade real […]

Comments are closed.