Taking a loan against your Life Insurance Corporation (LIC) policy can be an efficient and convenient way to secure funds during financial emergencies. However, just like any other financial decision, it requires careful consideration and understanding of key aspects. This comprehensive guide provides the essential information you need to know before taking a loan against your LIC policy.

Understanding Loan Against LIC Policy

What is a Loan Against LIC Policy?

A loan against LIC policy is a loan you can avail by using your LIC policy as collateral. This type of loan is often chosen for its relatively lower interest rates and the simplicity of the borrowing process. Essentially, the cash value of your LIC policy acts as the security or collateral for the loan, ensuring that you can access funds without undergoing intensive scrutiny or credit checks.

Eligibility Requirements

To be eligible for a loan against an LIC policy, you typically need to meet the following criteria:

– The LIC policy must have accrued a certain minimum surrender value. This usually implies that the policy should be at least 3 years old.

– The premiums of the policy should be fully paid up-to-date.

– The policyholder should be the one applying for the loan.

Key Advantages of Taking a Loan Against LIC Policy

Lower Interest Rates

One of the main advantages of opting for a loan against LIC policy is the lower interest rate compared to unsecured loans such as personal loans. The interest rates for loans against LIC policies generally range from 9% to 11%, making them a cost-effective option for those in need of quick funds.

No Credit Check

Because the loan is secured by the cash value of your LIC policy, lenders are often less concerned with your credit score. This means that even if you have a less-than-perfect credit history, you can still be eligible for a loan against your LIC policy.

Quick Processing

The application process for a loan against LIC policy is generally faster than for other types of loans. Since the policy is already considered a secured asset, the documentation and verification processes are significantly streamlined.

How Much Can You Borrow?

The loan amount you can borrow against your LIC policy is generally a percentage of the surrender value of the policy. Typically, insurers allow you to borrow up to 85%-90% of the policy’s surrender value. The exact amount may vary depending on the specific policy and the insurer’s terms.

Loan Repayment Terms

The tenure for repaying a loan against an LIC policy can vary. Insurers may offer flexibility in the repayment period, which could align with the term of the policy itself, or might require repayment within a few years. It’s crucial to understand the repayment terms set by your insurer to ensure that you can manage the repayments comfortably.

Key Points to Consider Before Taking a Loan Against LIC Policy

Interest Structure

Understanding the interest structure is vital. Loans against LIC policies can have either fixed or floating interest rates. A fixed-rate means that the interest rate remains constant throughout the loan tenure, whereas a floating rate might fluctuate based on market conditions. Knowing the type of rate beforehand will help you predict your future payments more accurately.

Impact on Policy Benefits

While taking a loan against your LIC policy doesn’t alter your policy benefits directly, failing to repay the loan can have significant consequences. In the event of non-repayment, the insurer may deduct the outstanding loan amount along with any accrued interest from the policy payout in case of a claim. Therefore, it’s crucial to stay current on your repayments to safeguard your policy benefits.

Processing Fees

Be aware of any processing fees associated with the loan. Though generally minimal, these fees can add up. Ensure you read the fine print regarding any administrative or service charges that might be applicable.

Tax Implications

Check the tax implications of taking a loan against LIC policy. While the loan itself is not taxable, the interest paid on the loan is also not deductible for tax purposes. Consult with a tax advisor to understand how the loan might affect your tax situation.

Alternative Financing Options

Before deciding to take a loan against your LIC policy, evaluate alternative financing options. Sometimes, other types of secured loans could offer better terms or more flexibility. Comparing different options can help you make a more informed decision.

Steps to Apply for a Loan Against LIC Policy

- Assess Your Policy Value: Determine the surrender value of your LIC policy, as it will dictate the maximum loan amount you can borrow.

- Submit the Application: Fill out the loan application form provided by the insurer. This form usually requires details of your LIC policy, the loan amount required, and other personal information.

- Provide Necessary Documents: Typically, insurers require you to submit the original LIC policy document, proof of paid premiums, and identity proof.

- Approval and Disbursement: Once your application is reviewed and approved, the loan amount will be disbursed either directly into your bank account or through a check.

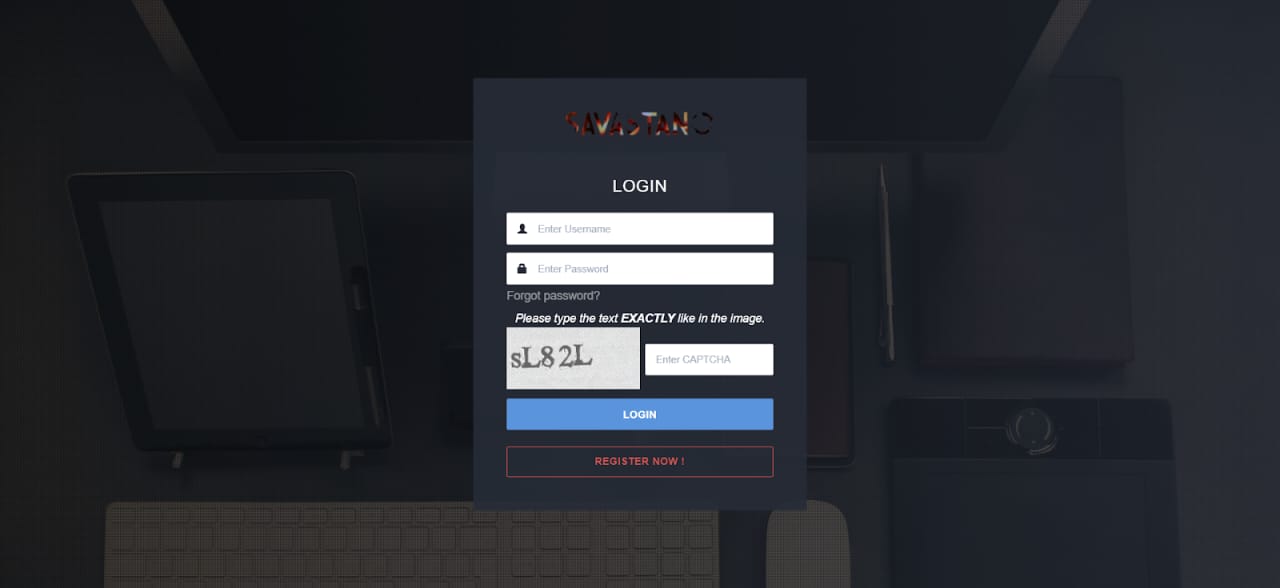

Exploring the Benefits of the Bajaj Finserv App for Financial Solutions

Before finalizing your decision to take a loan against your LIC policy, consider leveraging the Bajaj Finserv app for a seamless and efficient loan application process. The app offers a user-friendly interface that allows you to check eligibility, calculate EMIs, and upload necessary documents effortlessly. With real-time updates and secure processing, the app ensures transparency and convenience. Moreover, it provides access to various financial tools and services, making it a one-stop solution for managing your financial needs. Download the Bajaj Finserv app today to explore its features and simplify your loan journey.

Conclusion

Taking a loan against LIC policy can be an effective solution for financial needs. It utilizes the cash value of a life insurance policy to provide collateralized borrowing with several benefits, such as lower interest rates, no credit checks, and quick processing. However, it also comes with parameters that need careful consideration, like interest structures, impact on policy benefits, processing fees, and tax implications.

Before proceeding, one must thoroughly assess their financial situation, repayment capacity, and alternative financing options. By doing so, you can ensure that taking a loan against your LIC policy is both a beneficial and manageable financial strategy.