How SharkShop Helps People with Low Credit Scores Build a Stronger Rating

Are you tired of being held back by a low credit score? You’re not alone! For millions, navigating the financial world with a less-than-stellar rating can feel like an uphill battle. But what if we told you there’s a lifeline out there—a transformative tool designed to help you rebuild your credit and regain control of your financial future?

Enter Sharkshop.biz This innovative platform isn’t just another app; it’s your partner in progress, paving the way for those seeking to boost their creditworthiness without the usual hurdles. In this blog post, we’ll dive into how SharkShop empowers individuals with low credit scores to unlock opportunities they never thought possible. Say goodbye to frustration and hello to hope—let’s explore how you can start turning things around today!

Introduction to the Importance of Credit Scores

Your credit score is more than just a number; it’s a key that unlocks various doors in your financial life. It determines whether you’ll qualify for loans, secure housing, or even land certain jobs. Many people find themselves facing the harsh reality of low credit scores – often due to unforeseen circumstances like medical bills, job loss, or simply not understanding how to manage credit effectively.

But what if there was a way to turn things around? Enter Sharkshop.biz a platform designed specifically for those looking to improve their credit ratings and regain control over their financial futures. Let’s dive deeper into the world of SharkShop and discover how it can empower you on your journey toward better credit health.

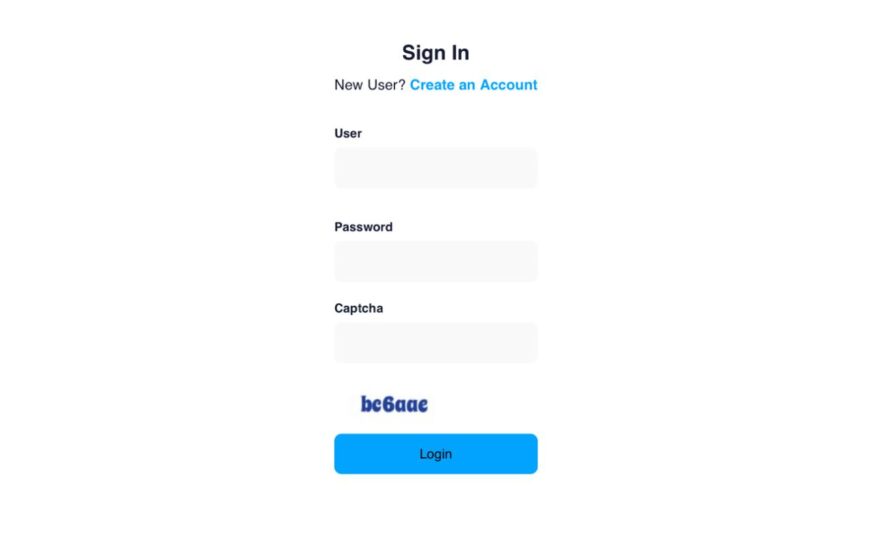

A Screenshot of Sharkshop (Sharkshop.biz) login page

Understanding Low Credit Scores and their Impact

Low credit scores can be a significant hurdle for many individuals. They often stem from missed payments, high debt levels, or even outdated information on credit reports. Unfortunately, these low ratings can lead to higher interest rates and difficulty obtaining loans.

When you have a low credit score, lenders see you as a risk. This perception makes it challenging to secure favorable terms for mortgages or car loans. You might also face obstacles in renting an apartment or getting approved for utility services.

In some cases, employers check credit scores during the hiring process. A poor score could hinder job opportunities as companies may view it as a reflection of your reliability.

Understanding the implications of a low credit score is essential. It affects not just financial decisions but various aspects of daily life too. Taking steps towards improvement can pave the way for better opportunities down the line.

What is SharkShop?

SharkShop is an innovative platform designed to empower individuals grappling with low credit scores. It offers tailored solutions that help users regain control of their financial futures.

Unlike traditional credit repair services, SharkShop combines technology and personalized support to create a user-friendly experience. The platform assesses individual credit situations and provides actionable steps for improvement.

Members gain access to resources such as educational content, budgeting tools, and expert advice. This comprehensive approach ensures that users not only fix their scores but also understand the fundamentals of managing credit responsibly.

SharkShop’s commitment goes beyond just numbers; it aims to build confidence in its members as they navigate the complexities of personal finance. With a focus on community engagement, SharkShop fosters an environment where users can share experiences and learn from each other’s journeys toward better credit health.

Related: Feshop

How SharkShop Works to Help People with Low Credit Scores

SharkShop operates on a simple yet effective premise. It aims to empower individuals with low credit scores by providing them with tailored solutions.

When you sign up, the platform analyzes your financial history and identifies areas for improvement. This personalized assessment is crucial in understanding specific challenges.

SharkShop offers various resources, including educational tools that explain credit scoring factors. Users learn how behaviors like timely payments can positively influence their scores.

Additionally, SharkShop partners with trusted lenders who cater to those rebuilding their credit. These partnerships provide access to products designed specifically for individuals looking to improve their financial standing.

The user-friendly interface makes it easy for clients to track progress over time. Regular updates ensure that users stay motivated as they navigate their journey towards better credit health.

Success Stories from SharkShop Customers

SharkShop has transformed countless lives through its innovative credit-building solutions. One customer, Sarah, faced constant rejection due to her low score. After using SharkShop’s personalized strategies, she saw a remarkable improvement in just six months.

Then there’s Mark, who struggled with mounting debt and poor credit history. He turned to SharkShop for guidance and learned how to manage his finances effectively. Today, he boasts a much higher score and is on track to buy his first home.

These stories showcase resilience and the power of support from SharkShop. Each success highlights not only improved credit scores but also renewed confidence among users ready to take charge of their financial futures. Customers are sharing their journeys online, inspiring others facing similar challenges to believe that change is possible with the right tools at hand.

Tips for Building a Stronger Credit Score with SharkShop

Building a stronger credit score with SharkShop login is an empowering journey. Start by utilizing their personalized credit-building programs tailored to your unique financial situation.

Make consistent, on-time payments for any loans or bills you have. This habit alone can significantly boost your score over time.

Monitor your credit report regularly through SharkShop’s tools to identify errors and discrepancies. Disputing inaccuracies can lead to quick improvements in your rating.

Engage with educational resources offered by SharkShop. Knowledge about responsible credit usage will help you make informed decisions moving forward.

Consider secured credit cards or small installment loans that are available through the platform, as they can also aid in building positive payment history without overwhelming debt obligations.

Lastly, keep your overall debt levels low relative to available credit limits; this ratio plays a crucial role in how lenders view you.

Alternatives to SharkShop for Improving Your Credit Score

If SharkShop cc isn’t the right fit for you, there are several alternatives worth exploring. One popular option is credit counseling services. These organizations offer guidance on managing debt and improving your financial literacy.

Another route to consider is secured credit cards. They require a cash deposit as collateral but can help rebuild your score when used responsibly. Each timely payment contributes positively to your credit history.

Peer-to-peer lending platforms also provide unique solutions. They connect borrowers with individual investors willing to fund loans, often at competitive rates.

Lastly, consider becoming an authorized user on someone else’s account. This allows you to benefit from their positive credit habits without being responsible for payments directly. Each alternative has its pros and cons; it’s essential to research thoroughly before making a decision that suits your needs best.

Conclusion: The Benefits of Using SharkShop and Taking Control of Your Financial Future

Sharkshop.biz offers a path to financial empowerment for those struggling with low credit scores. By providing tailored resources, personalized advice, and innovative tools, it enables users to improve their credit standing effectively. The platform not only helps individuals monitor their progress but also educates them on best practices for maintaining a strong credit score.

Users can take comfort in the success stories shared by SharkShop clients who have transformed their financial futures through diligence and support from the platform. With practical tips at hand, anyone can work towards building a robust rating over time.

Choosing SharkShop means taking control of your finances and investing in your future. It opens doors that might otherwise remain closed due to poor credit history. As more people engage with these helpful services, they discover newfound confidence in managing their financial lives—proving that it’s never too late to start rebuilding your credit score today.